Revolutionizing Lending Through Strategic Branding and Digital Innovation

Client Overview

VeriFund Lending is a modern financial services company specializing in innovative lending solutions for individuals and businesses. With a focus on streamlined processes, competitive rates, and exceptional customer service, VeriFund positions itself as a forward-thinking alternative to traditional lending institutions.

The Challenge

VeriFund Lending approached Octo Strategies with the ambitious goal of establishing themselves as a leading player in the competitive lending market:

- Market Differentiation: Needed to stand out in a crowded lending landscape dominated by established financial institutions

- Trust Building: Essential to establish credibility and trustworthiness in the financial services industry

- Technology Integration: Required seamless integration of various lending technologies and platforms

- Brand Identity: Lacked a cohesive brand that reflected their innovative approach and professional expertise

- Digital Presence: Needed a comprehensive online presence that could compete with larger institutions

- Operational Efficiency: Required systems that could scale with their growing business

- Social Media Strategy: Needed to establish thought leadership and customer engagement in the financial sector

Our Comprehensive Retainer Solution

Monthly Retainer Model

We established a comprehensive monthly retainer that provides ongoing strategic support across all marketing and operational needs, allowing VeriFund to focus on their core lending business while we handle their growth-focused marketing initiatives.

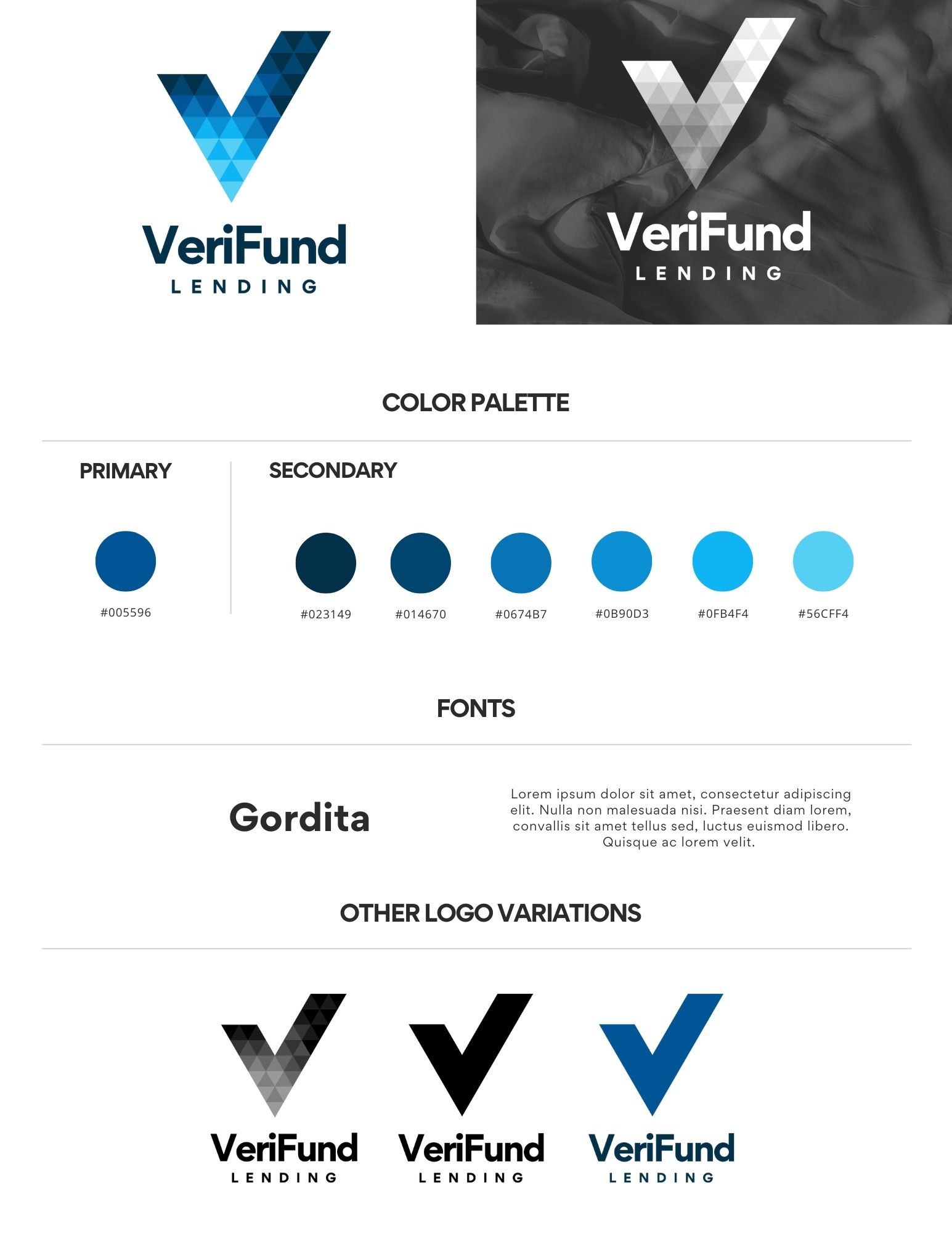

Brand Identity Development

Strategic Brand Foundation

- Developed a modern, trustworthy brand identity that communicates innovation and reliability

- Created a professional color palette that conveys financial stability and forward-thinking approach

- Established typography and visual standards that work across digital and traditional media

- Built comprehensive brand guidelines ensuring consistent application across all touchpoints

Visual Identity System

- Designed a distinctive logo that reflects their technological edge and professional expertise

- Created supporting brand elements that enhance recognition and credibility

- Developed a cohesive visual language for all marketing materials and digital platforms

- Established photography and imagery standards that align with their brand positioning

Website Development

Custom Website Design

- Built a professional, conversion-focused website that showcases their lending expertise

- Implemented user-friendly loan application processes and calculators

- Created educational content sections explaining different lending options and processes

- Integrated client testimonials and success stories to build trust and credibility

User Experience Optimization

- Designed intuitive navigation that guides visitors through their service offerings

- Implemented clear calls-to-action throughout the site to encourage loan applications

- Created mobile-responsive design ensuring optimal experience across all devices

- Integrated live chat and contact systems for immediate customer support

Technology Integration

Lending Platform Integration

- Seamlessly integrated various lending technologies and CRM systems

- Implemented automated workflow systems for loan processing and customer management

- Created unified data management systems across all platforms

- Established secure, compliant integrations meeting financial industry standards

Performance Optimization

- Integrated analytics and tracking systems for comprehensive performance monitoring

- Implemented automated reporting systems for key business metrics

- Created dashboard systems for real-time business intelligence

- Established backup and security protocols for all integrated systems

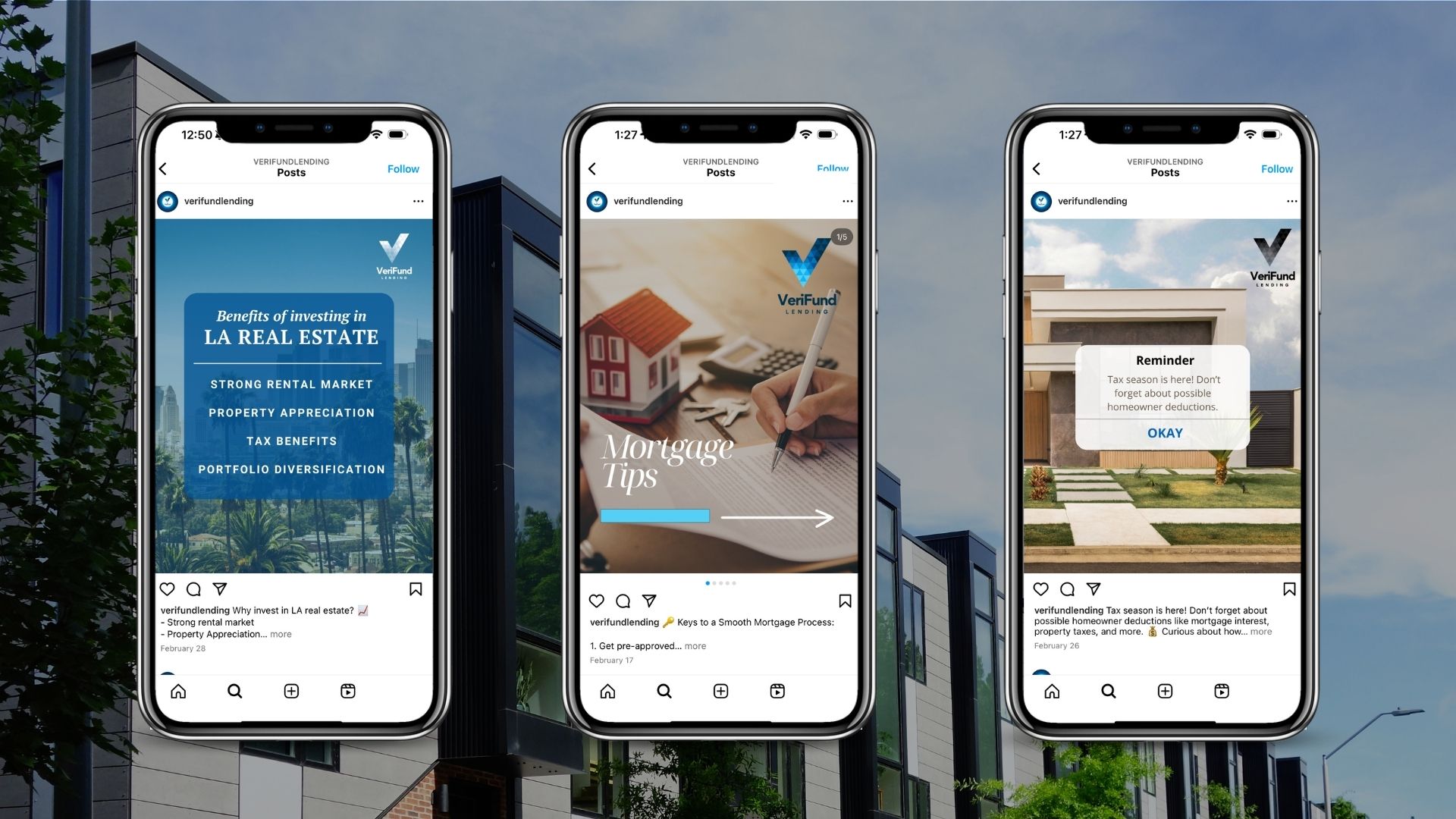

Social Media Strategy & Management

Content Strategy Development

- Created educational content calendar focusing on financial literacy and lending guidance

- Developed thought leadership content positioning VeriFund as industry experts

- Implemented client success stories and testimonials (with appropriate privacy considerations)

- Created timely content around market trends and lending industry developments

Platform Management

- Managed LinkedIn presence for B2B relationship building and thought leadership

- Developed Facebook strategy for consumer lending education and community building

- Created Instagram content showcasing company culture and customer success

- Implemented social media advertising campaigns targeting qualified lending prospects

Engagement & Community Building

- Built relationships with financial advisors, real estate professionals, and industry partners

- Created engagement strategies around financial education and responsible lending

- Developed social media customer service protocols

- Established influencer partnerships within the financial services community

Results & Impact

Our comprehensive retainer approach has delivered significant results for VeriFund Lending:

Enhanced Market Position

- Established VeriFund as a recognizable brand in the competitive lending market

- Improved credibility and trust among potential borrowers and industry partners

- Enhanced competitive positioning against larger, established financial institutions

Operational Excellence

- Streamlined lending processes through effective technology integration

- Improved customer experience through cohesive digital touchpoints

- Enhanced efficiency through automated systems and workflows

Lead Generation & Conversion

- Increased website traffic and loan application submissions

- Improved social media engagement and follower growth

- Enhanced lead quality through targeted digital marketing strategies

- Strengthened referral relationships through professional networking

Brand Recognition

- Established thought leadership position in the lending industry

- Improved brand awareness among target demographics

- Enhanced professional reputation within the financial services community

Scalable Growth Foundation

- Created systems and processes that support business expansion

- Established marketing infrastructure that grows with the business

- Built technology integrations that scale with increasing loan volume

The Financial Services Advantage

Our approach to financial services marketing demonstrates:

Regulatory Compliance: Understanding of financial industry regulations and compliance requirements

Trust Building: Expertise in establishing credibility in an industry where trust is paramount

Technology Integration: Ability to seamlessly integrate complex financial technologies and platforms

Professional Positioning: Creating brand presence that competes effectively with established institutions

Ongoing Partnership: Providing consistent, strategic support through our retainer model

The Octo Strategies Difference

This case study showcases our comprehensive approach to financial services marketing:

Industry Expertise: Deep understanding of the lending industry, customer needs, and competitive landscape

Technical Integration: Ability to seamlessly integrate complex systems and platforms

Holistic Strategy: Coordinating branding, web development, technology, and social media into unified growth strategy

Scalable Solutions: Creating systems that support business growth and expansion

Ongoing Partnership: Providing consistent strategic support that adapts to changing business needs

VeriFund Lending's transformation demonstrates how strategic branding, technology integration, and comprehensive marketing support can position a growing company to compete effectively in established markets. Through our monthly retainer model, we've provided them with the consistent, expert support needed to build their brand, streamline operations, and achieve sustainable growth.

The integrated approach across branding, web development, technology integration, and social media has created a powerful foundation for continued success in the competitive lending industry.